“Stealth taxes” will push more than 3 million workers into a higher Income Tax bracket by 2029

While chancellor Jeremy Hunt announced he’d cut the rate of National Insurance (NI) in the 2023 Autumn Statement, he failed to change the thresholds or rates for Income Tax. While that might seem like a good thing – it’s better for your finances than a rate rise after all – your tax liability could still increase.

“Stealth taxes” refer to government policies that increase tax revenue even though they’re not labelled as tax hikes. Through freezing Income Tax thresholds, the government may benefit more than you expect.

Income Tax thresholds are frozen until April 2028

Income above your Personal Allowance, which is £12,570 in 2023/24, could be subject to Income Tax.

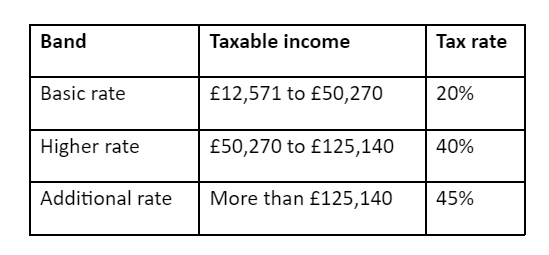

The rate of Income Tax you pay depends on which band your earnings fall into. For 2023/24, the Income Tax thresholds and rates are:

Please note Income Tax bands, thresholds, and rates are different in Scotland.

Crucially, the Personal Allowance and Income Tax thresholds are frozen until the 2027/28 tax year rather than increasing in line with inflation. This can lead to “fiscal drag”, where taxpayers are dragged into a higher tax bracket, even if their income hasn’t increased in real terms.

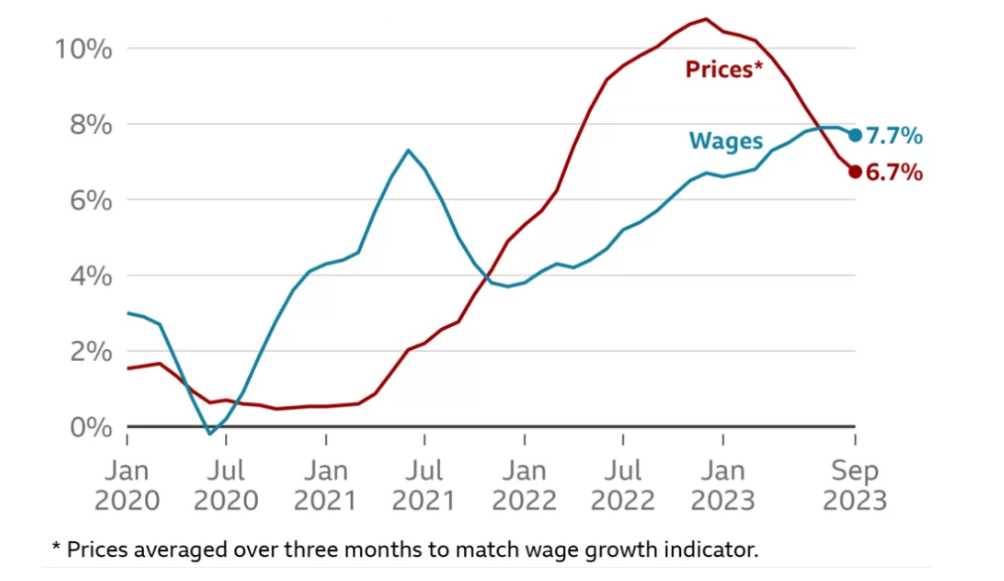

Furthermore, while you might have benefited from a rise in income, for much of the last two years, inflation has been higher than wage growth. So, many workers haven’t experienced a boost in their salary in real terms.

According to a BBC report, wage growth outpaced inflation in September 2023 for the first time since 2021.

Source: BBC

As a result, not only may your wages be failing to keep up with inflation, but you could find you’re pushed into a higher tax bracket. These so-called stealth taxes could mean your Income Tax liability increases more than you expect, and it may have a knock-on effect on your long-term financial plan.

Millions of taxpayers are expected to be affected by fiscal drag

According to figures from the Office for Budget Responsibility (OBR), the government’s policy of freezing Income Tax thresholds means that by 2028/29:

● Nearly 4 million additional people are expected to pay Income Tax

● 3 million more will start paying the higher rate

● 400,000 workers will be dragged into the additional-rate bracket.

The figures represent a significant increase in the number of taxpayers in each band of Income Tax. The number of higher-rate and additional-rate taxpayers is expected to soar by 68% and 49% respectively.

Of course, this will boost government coffers. The freezes are estimated to raise £42.9 billion by 2027/28.

Indeed, the OBR said frozen thresholds are the “largest contributor to the rising overall economy-wide tax burden – responsible for almost a third of the 4.5% of GDP increase in taxes from 2019/20 to 2028/29”.

The cuts to NI offset some of the fiscal drag, but many taxpayers are likely to find their tax burden is higher overall.

On 6 January 2024, the main rate of employee NI was cut from 12% to 10% – saving the average employee earning £35,400 a year more than £450 annually. In addition, NI contributions for the self-employed will be cut from April 2024.

Yet, the OBR finds that the reduction in the employee rate of NI will reduce the government’s budget by only £180 million – far below the amount it expects to raise through Income Tax threshold freezes.

There may be ways you could reduce your Income Tax bill

The good news is that there may be steps you could take to reduce your Income Tax bill in a way that supports your finances now as well as your long-term goals.

Depending on your circumstances, you may want to:

● Check if you could use the Marriage Allowance if your spouse or civil partner’s income doesn’t exceed the Personal Allowance

● Increase your pension contributions to reduce your taxable income

● Save through an ISA to reduce the tax you pay on the interest your savings earn

● Make use of salary sacrifice schemes your employer offers

● Use dividends to supplement your salary.

The above list isn’t exhaustive and it’s important to weigh up the pros and cons before you proceed.

Arrange a meeting with us to talk about your tax liability

If you’d like to understand if there are steps you could take to reduce your tax liability, please contact us to arrange a meeting. We can work with you to create a tailored plan that reflects your circumstances and goals.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.